Social Security Benefits 2025: Navigating the Labyrinthine complexities

Social Security, a cornerstone of the United States' social welfare system, provides vital financial assistance to millions of Americans. As the year 2025 approaches, significant changes to Social Security benefits are looming on the horizon, bringing forth a multitude of complexities and uncertainties. This essay delves into the intricate web of Social Security Benefits 2025, examining the updated payment calendar and schedule while critically analyzing diverse perspectives and scholarly research.

The Updated Payment Calendar and Schedule: Navigating the Uncertainties

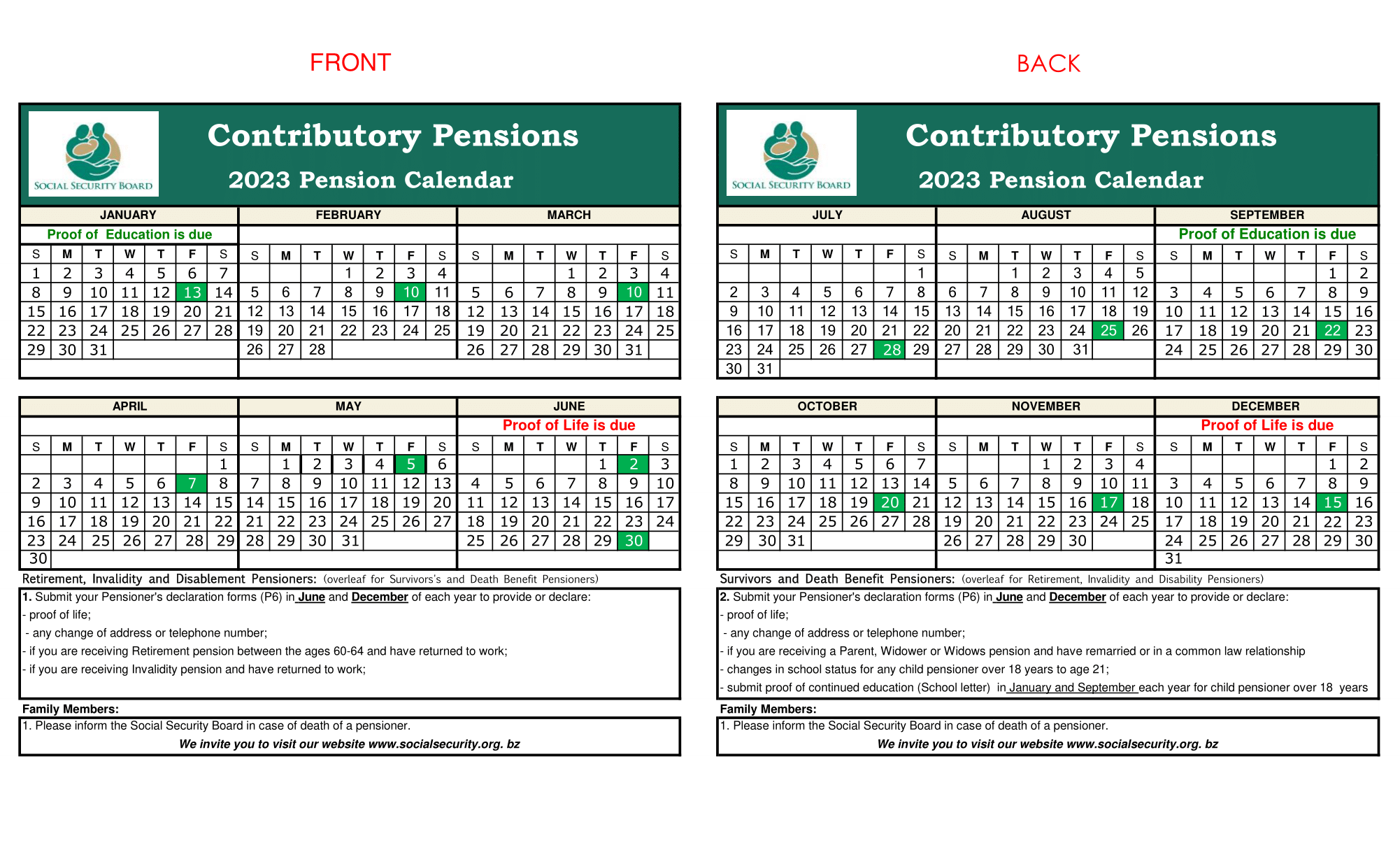

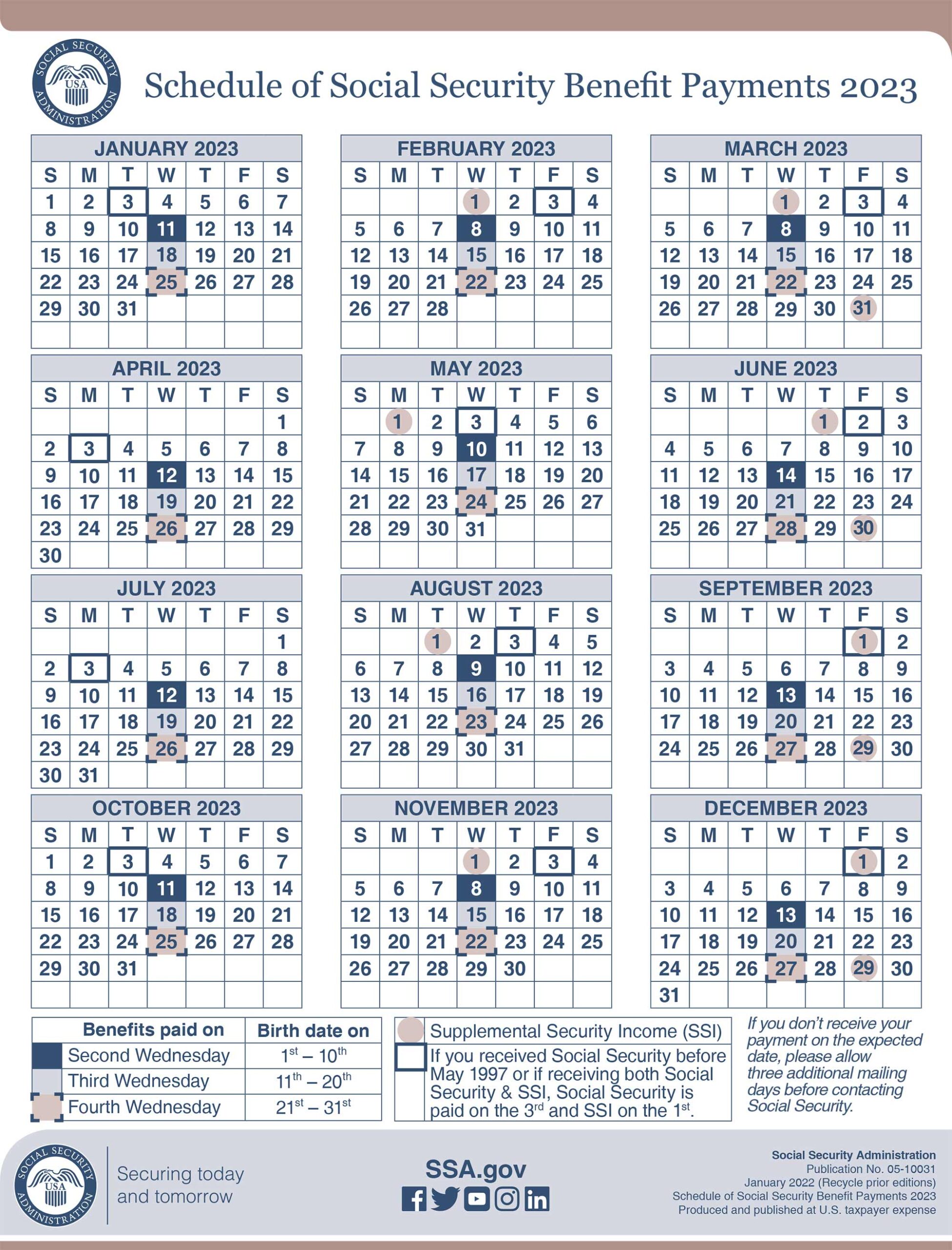

The Social Security Administration (SSA) has released an updated payment calendar and schedule for 2025, outlining the specific dates on which Social Security beneficiaries will receive their monthly payments. These dates vary depending on the recipient's birthdate and the type of benefit they receive. For instance, individuals born between January and March will receive their payments on the second Wednesday of each month, while those born between October and December will receive their payments on the third Wednesday of each month.

The updated schedule is designed to ensure that all beneficiaries receive their payments on a timely and consistent basis. However, it is crucial to note that these dates may be subject to change in the future, depending on various factors such as legislation, economic conditions, and administrative decisions. Beneficiaries are advised to stay informed and regularly check with the SSA for any updates or modifications to the payment schedule.

The Impact of the Social Security Trust Fund Depletion: A Looming Crisis?

One of the primary complexities surrounding Social Security Benefits 2025 is the impending depletion of the Social Security Trust Fund. The Trust Fund, which is funded by payroll taxes, is projected to be exhausted by 2035, raising concerns about the long-term sustainability of the program.

If the Trust Fund is depleted, the SSA will be forced to reduce benefits across the board by approximately 20%. This would have a significant impact on millions of Americans who rely on Social Security as a primary source of income. To address this issue, various proposals have been put forward, including raising the payroll tax rate, increasing the retirement age, and reducing benefits for wealthier individuals.

Diverse Perspectives on Social Security Reform: Finding a Consensus

There is a wide range of perspectives on how to address the complexities of Social Security Benefits 2025. Some argue that the program should be privatized, while others believe that it should be expanded to provide additional benefits. There are also those who advocate for raising the retirement age or reducing benefits across the board.

Each of these perspectives has its own merits and drawbacks. Privatization could potentially increase returns for some individuals, but it also carries the risk of reduced benefits and increased volatility. Expanding benefits could provide much-needed support to low-income individuals, but it would also require additional funding. Raising the retirement age could help to preserve the Trust Fund, but it would also disproportionately impact low-wage workers.

Finding a consensus on how to reform Social Security will be a complex and challenging task. It is essential to engage in robust public discourse, consider the diverse perspectives, and evaluate the potential impacts of different proposals before making any final decisions.

Implications for the Future of Social Security: A Call for Sustainable Solutions

The complexities surrounding Social Security Benefits 2025 have far-reaching implications for the future of the program. The impending depletion of the Trust Fund, coupled with the growing number of retirees, poses a significant challenge to the long-term sustainability of the system.

Addressing these challenges will require a comprehensive and bipartisan approach. It is crucial to engage in evidence-based policymaking, considering the potential impacts of different reform proposals on all Americans, especially the most vulnerable populations. Finding a sustainable solution for Social Security will ensure that this vital program continues to provide essential financial assistance for generations to come.

Conclusion: A Path Forward Amidst Complexity

The complexities surrounding Social Security Benefits 2025 present a multitude of challenges and opportunities. By understanding the updated payment schedule, considering diverse perspectives, and engaging with scholarly research, we can navigate these complexities and work towards a sustainable future for Social Security.

Finding a consensus on how to reform the program will not be easy, but it is essential to engage in robust public discourse and consider the potential impacts of different proposals. By working together, we can ensure that Social Security continues to provide vital financial assistance to millions of Americans for generations to come.

Angelina Jolie: The Actress Who Inspires On And Off Screen

Taylor Swift: The Songwriting Sensation Who Dominates The Charts

Shohei Ohtani: The Baseball Phenomenon Who Redefines The Role Of Pitcher And Hitter